SK

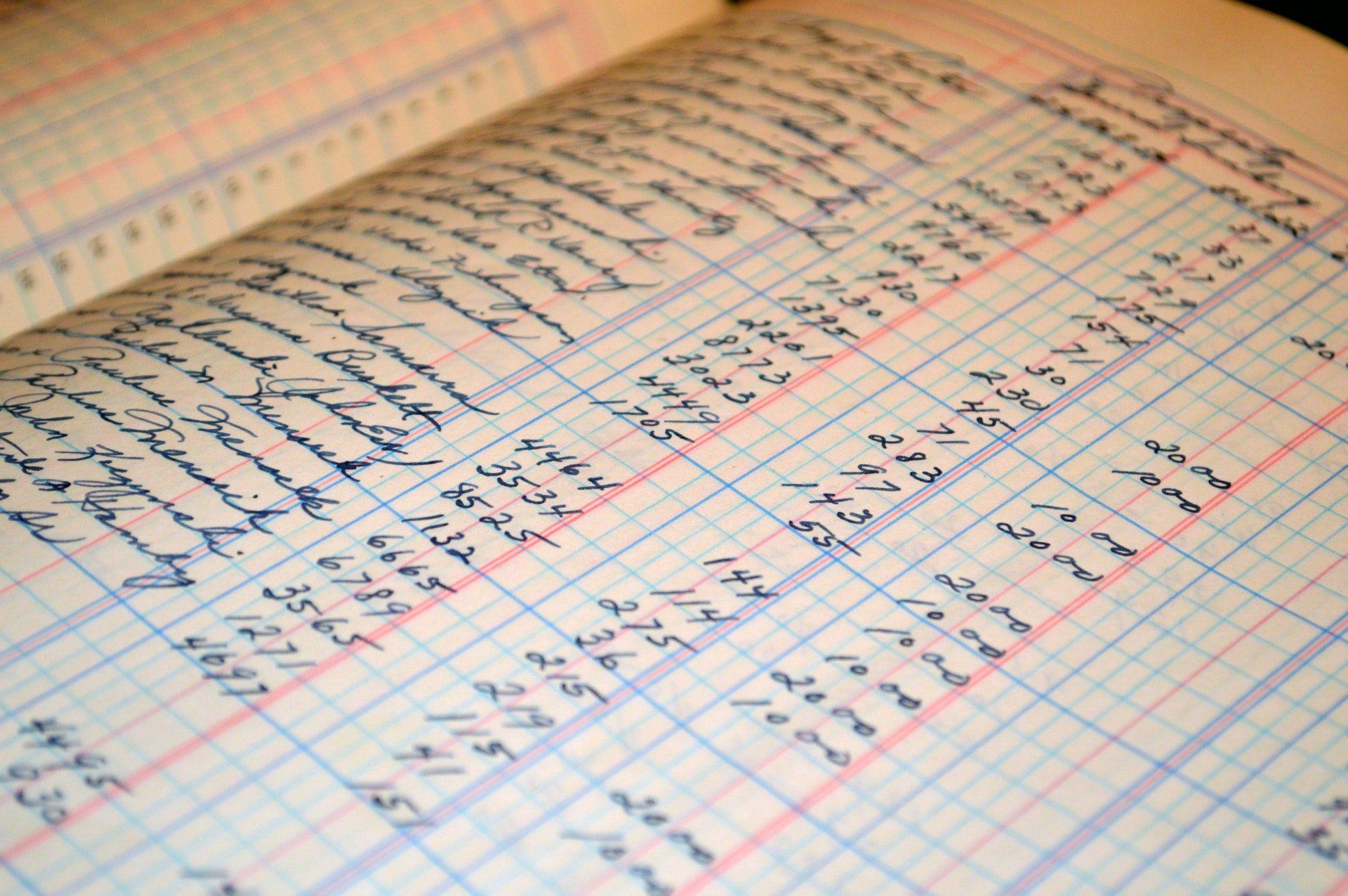

BOOKKEEPING SERVICES

Balance Sheet vs. Income Statement: How Understanding Both Can Help Grow Your Profit and Business

Balance Sheet vs. Income Statement: How Understanding Both Can Help Grow Your Profit and Business

As a small business owner, understanding your financial health is crucial for growth and profitability. Two essential financial statements that provide insight into your business’s performance are the balance sheet and the income statement. While they serve different purposes, they are deeply interconnected and, when analyzed together, can give you a complete picture of your financial situation, helping you make informed decisions that drive profit and growth.

In this article, we’ll break down the differences between the balance sheet and income statement, explain how they collaborate to show your business’s financial health, and discuss how to use them to grow your business.

What is a Balance Sheet?

A balance sheet provides a snapshot of your business’s financial position at a specific point in time. It shows what your business owns (assets), what it owes (liabilities), and the owner’s equity, which represents the net worth of your business.

Key Components of a Balance Sheet:

- Assets:

- Current Assets: These are assets that can be easily converted into cash within a year, such as cash, accounts receivable, and inventory.

- Non-Current Assets: These include long-term investments, property, equipment, and other assets that cannot be easily liquidated.

2. Liabilities:

- Current Liabilities: These are obligations the business must pay within a year, such as accounts payable, short-term loans, and taxes owed.

- Non-Current Liabilities: Long-term debts like mortgages or bonds payable that extend beyond one year.

3. Owner’s Equity:

This represents the value left over for the owners after all liabilities have been settled. It includes retained earnings and any capital invested by the owners.

Why It’s Important:

The balance sheet helps you assess your business’s financial stability and liquidity. It shows whether your business has enough assets to cover liabilities and provides insight into how much of the business is funded by debt versus owner investment.

What is an Income Statement?

The income statement (also known as the profit and loss statement) shows your business’s financial performance over a specific period, typically monthly, quarterly, or annually. It tracks your revenues, costs, and expenses to calculate your net profit or loss.

Key Components of an Income Statement:

- Revenue: This is the total income generated from the sale of goods or services during the period.

- Cost of Goods Sold (COGS): These are the direct costs associated with producing or delivering your products or services.

- Gross Profit: The difference between revenue and COGS. It reflects how efficiently your business is generating profit from sales.

- Operating Expenses: These include rent, utilities, marketing, salaries, and other general expenses required to run your business.

- Net Profit (or Loss): The final profit after subtracting all expenses (COGS and operating expenses) from your revenue. This is also known as the “bottom line.”

Why It’s Important:

The income statement provides a detailed view of your business’s profitability. It helps you understand how much money your business is making (or losing) over a period and where your expenses are going. This is essential for evaluating the overall financial health of your business.

How the Balance Sheet and Income Statement Work Together

While the balance sheet and income statement provide different perspectives, they are interconnected and together offer a complete view of your financial performance. Here’s how:

- Profitability vs. Financial Position:

- Income Statement: Shows whether your business is making a profit over a specific period, which directly affects your owner’s equity on the balance sheet.

- Balance Sheet: Reflects the long-term financial position of your business, showing your assets, liabilities, and equity at a given point in time.

- Tracking Cash Flow:

- Income Statement: Tracks your revenue and expenses, but it doesn’t always reflect actual cash flow (e.g., sales on credit).

- Balance Sheet: Helps you see how much cash you actually have on hand (current assets like cash and accounts receivable) and what obligations are due soon (current liabilities).

- Measuring Debt and Risk:

- Income Statement: Shows whether you are generating enough profit to cover your interest payments and other financial obligations.

- Balance Sheet: Helps assess your overall debt load and the ability to repay it. High liabilities compared to assets may indicate financial risk, while low debt can signal a stable financial position.

- Growth and Investment Decisions:

- Income Statement: Highlights profitability trends, showing whether your sales are growing and how efficiently you’re managing costs.

- Balance Sheet: Provides insight into how much capital you have available for reinvestment into the business, such as purchasing equipment, hiring employees, or expanding operations.

Using Both Statements to Grow Your Profit and Business

Understanding how to interpret both the balance sheet and income statement can guide you in making better financial decisions that directly impact your profitability and business growth. Here’s how:

1. Monitor Profit Margins and Operating Efficiency

- Use your income statement to monitor your gross profit margin (revenue minus COGS) and operating profit margin (profit after operating expenses). These metrics help you understand how efficiently you’re producing goods or services and managing day-to-day operations.

- If your margins are shrinking, it may be time to evaluate your pricing strategy, reduce expenses, or find more cost-effective suppliers.

2. Improve Cash Flow Management

- Combine the insights from your balance sheet and income statement to get a clearer picture of your cash flow. For example, your income statement might show profitability, but your balance sheet may reveal that most of your assets are tied up in unpaid invoices (accounts receivable).

- Improve your cash flow by tightening payment terms, offering discounts for early payments, or focusing on more effective inventory management to free up cash for operations.

3. Manage Debt Wisely

- Use your balance sheet to keep an eye on your debt-to-equity ratio. A high ratio may indicate that your business is over-leveraged, while a low ratio can signal financial stability.

- Compare this with your income statement to ensure that you’re generating enough profit to comfortably cover your debt payments. If your profit margins are shrinking while your debt levels are rising, you may need to reconsider your financing strategy.

4. Plan for Growth and Investment

- Use your balance sheet to determine how much available cash or equity you have to reinvest in the business. This could include expanding your product line, investing in new equipment, or hiring more staff.

- Your income statement can help guide these decisions by showing which products or services are the most profitable and where your business could scale more efficiently.

5. Benchmark Performance Over Time

- By regularly reviewing both your income statement and balance sheet, you can track key financial metrics over time, such as revenue growth, expense control, and debt management. This allows you to spot trends and make adjustments as needed.

- Set financial goals based on these metrics, such as increasing profit margins, reducing debt, or growing cash reserves, and use these reports to measure your progress.

Conclusion: Leveraging Both Financial Statements for Business Growth

The balance sheet and income statement are essential tools for understanding your business’s financial health. While the income statement helps you track profitability and identify opportunities to improve efficiency, the balance sheet offers a snapshot of your financial stability and helps you plan for long-term growth.

By collaborating with both statements, you can get a full picture of how your business is performing and where it’s headed. At Sihamkami Bookkeeping Services, we can help you regularly analyze these financial statements to ensure you’re making informed decisions that will boost your profit and grow your business. Contact us today to learn how we can support your financial management and take your business to the next level!

This article educates your audience about the importance of understanding both the balance sheet and income statement while promoting your bookkeeping services as a key resource for business growth. Let me know if you’d like any adjustments!

Want more information?

SK

BOOKKEEPING SERVICES